2020 is a leap year and Saturday, 29th of February marks the leap day: an extra day in our lives that we encounter every four years. Walking through February 29 is almost like walking through a rare portal that is only accessible to us every four years. Well, when I dug a little deeper into the history of how we actually came to have 29 days in the second month of the year, I found some very interesting facts about this day.

The history of Feb 29th (and/or of Feb 28th for that matter)

A leap year was needed to correct calendar drift because the Earth orbits the Sun every 365.242 days, a number that is fairly difficult to accommodate on a calendar. And it was a lot of trial and error before the world could settle for the modern-day leap year system. Many ancient cultures had taken on to the practice of adding extra days, or even months, to round out the calendar year.

The National Geographic News explains the Roman civilization would add months to try to correct the drift of the lunar calendar. But this system was sloppy. In the modern sophisticated society, all kinds of things such as paying rent or interest accruing on loans would all mess up.

Egyptians were the first to determine the true length of the solar year and brought the reformation. Egypt adopted a leap-year system, with an extra day every four years, during the Greek rule of the Ptolemaic Dynasty (305 to 30 BC).

In 46 BC, the Julian calendar came to be used as a reformed calendar after what came to be known as the Year of Confusion. But there was an inherent flaw that caused the drifted Julian calendar to drift 10 days by the late 16th century. In 1582 the Gregorian calendar was introduced by Pope Gregory XIII, and it slowly but surely became the main calendar system for most of the world.

Now you might be wondering why I am talking about the history of leap years? Well, apart from its historic relevance, I consider the leap days significant as the day of reflection and reminiscence.

A day for reflection

A wise person would say, don’t live in the past nor the future, stay in your present. However, it is important to foresee the future to identify the goals you want to achieve and reflect on the past to see how far you have come along your planned path, appreciate your achievements, recognize the pitfalls and improve upon them.

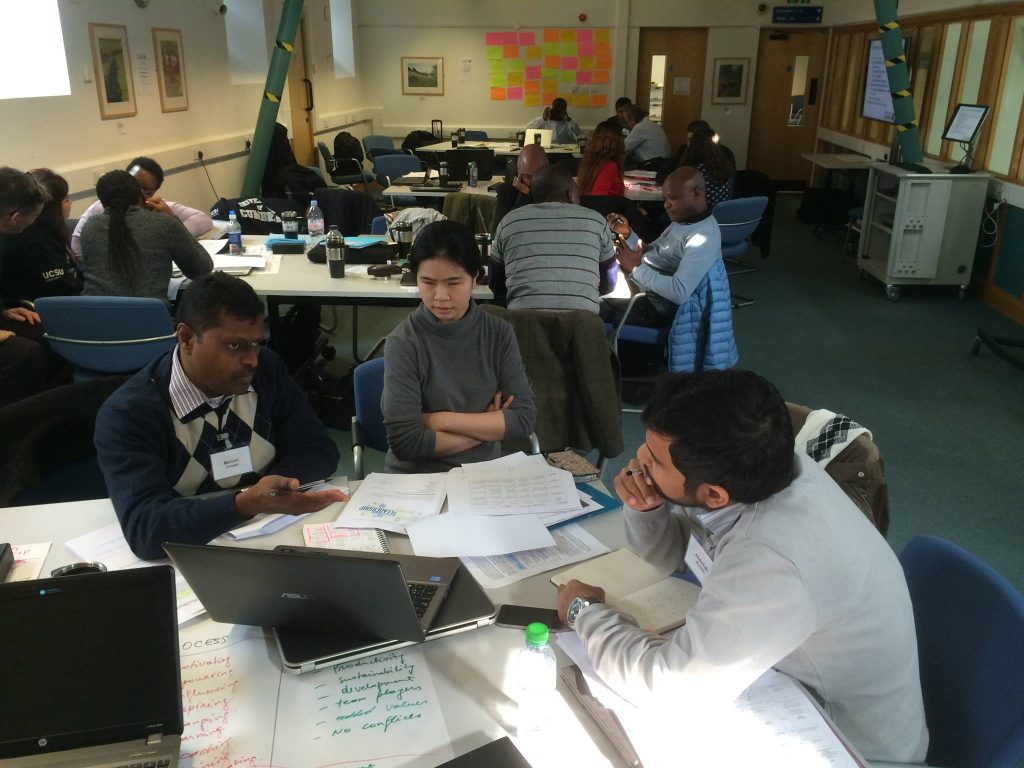

Reflection is a key part of learning – it is not dwelling or beating yourself up for past events, but rather recognizing the pros and cons of past experience. Standing on the leap day today, I would like to take this opportunity to highlight the achievements and memorable moments for Robert Kennedy College and its exclusive partners, during the last 4 years of imparting Swiss quality education online.

Scroll through the slides to see some of my favourite highlights of RKC history..

To top it all here’s a short University of Cumbria 2019 graduation video. I hope this inspires you to take the walk as a proud master’s graduate yourself one day (hopefully before the next leap year in 2024!)

So I would encourage you all to take the opportunity that this great day, that comes once in 4 years, has to offer. Reflect, plan, set your intentions and take the plunge! For any guidance that you might seek on our Master’s programme, just reach out to our dedicated education advisors.

Happy Leap Day!