As we step into the promising realm of 2024, the world is poised for transformative changes across various domains. Technological advancements, societal shifts, and global challenges are shaping the landscape of the future. In this blog post, we’ll explore the top five trends that are likely to define and influence the year 2024.

The Rise of Sustainable Technology

One of the most significant trends to watch in 2024 is the accelerated adoption of sustainable technologies. With a growing awareness of climate change and environmental issues, industries are increasingly investing in eco-friendly solutions. From renewable energy sources like solar and wind power to electric vehicles and sustainable packaging, technology is playing a pivotal role in creating a greener and more sustainable future. Expect to see breakthroughs in clean energy, efficient waste management systems, and innovations that contribute to a circular economy.

The Evolution of Artificial Intelligence (AI) and Automation

AI and automation have been on an upward trajectory for several years, and 2024 will see these technologies reaching new heights. Intelligent automation, machine learning, and natural language processing will become more sophisticated, leading to increased efficiency across various industries.

From personalized customer experiences to streamlined business operations, AI will continue to transform the way we live and work. However, ethical considerations and responsible AI practices will also become crucial topics of discussion, ensuring that these technologies are deployed ethically and inclusively.

Digital Health Revolution

The global pandemic has accelerated the digitization of healthcare, and in 2024, we can expect a digital health revolution. Telemedicine, wearable health tech, and AI-driven diagnostics will become more prevalent, offering personalized and accessible healthcare solutions. Remote patient monitoring, virtual consultations, and health-focused apps will empower individuals to take control of their well-being. The integration of big data in healthcare will enable predictive analytics, leading to more effective disease prevention and early intervention strategies.

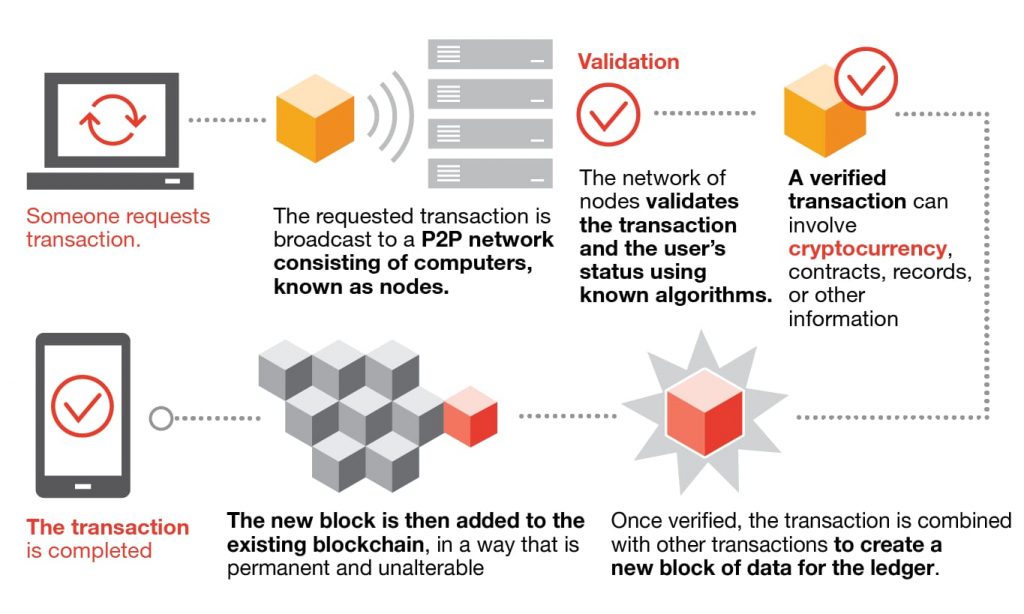

Decentralized Finance (DeFi) and Blockchain

Decentralized Finance (DeFi) and blockchain technologies are poised to disrupt traditional financial systems in 2024.

Blockchain’s transparent and secure nature will continue to gain traction in sectors beyond cryptocurrency, such as supply chain management, voting systems, and identity verification. DeFi, which leverages blockchain to recreate and improve upon traditional financial services, will provide more inclusive and accessible banking solutions. Expect innovations in decentralized exchanges, lending platforms, and new financial instruments that challenge the status quo.

Cultural Shifts in Remote Work and Flexible Work Arrangements

The way we work underwent a profound transformation during the pandemic, and in 2024, we will witness a continuation of this trend. Remote work and flexible work arrangements will become more ingrained in corporate cultures. Companies will focus on optimizing hybrid work models, leveraging advanced collaboration tools, and prioritizing employee well-being. The physical office space may undergo a reimagining, serving as collaborative hubs rather than mandatory daily destinations. This shift will impact not only how businesses operate but also the work-life balance and career expectations of individuals.

The year 2024 promises to be a dynamic and transformative period marked by advancements in technology, a heightened focus on sustainability, and a reshaping of societal norms. From the rise of sustainable technology to the evolution of AI, digital health, blockchain, and changes in work dynamics, these trends will shape the way we live and interact with the world around us. As we navigate through these transformative times, it’s essential to embrace innovation responsibly and ensure that progress benefits all of humanity. The future is exciting, and staying informed about these trends will help individuals and businesses adapt and thrive in the years to come.

Navigate your future towards stability, success in your career by joining our online Master’s and PhD. programme. Speak to one of our advisors to know more about the admission process, intake information and fee details.