Through the #DILO series of blog posts, we have been bringing you insights into the life of our master’s students, sharing their thoughts and opinions, ups and downs, and key learning points during their online studies. The whole idea behind this series is to make you aware of the realities of online studies and help you in making a decision.

This week, we look at a day in the life of one of our MSc Human Resource Management and Development student. Let’s hear about his experience studying for an online master’s degree programme.

An Introduction

Which university are you studying with?

University of Salford (UoS)

Which programme did you choose and why?

MSHRD – the field that I am currently working.

Who you are, really?

A proud RKC student 🙂

The Study Plan

How did you plan to study each module, and what was the reality? How many hours did/do you have to put in each day/or in a week?

It was very hard planning to study as I have my own business and children. I panned two hours a day/ 3 days a week for studies. This time was not enough for me. Realistically, I should have put at least 10 hours every week for studies and research.

What part of the day did/do you find most suitable to study? (e.g. early mornings, lunch break, evenings, weekends?)

Evenings and weekends.

How much time did you devote for each assignment?

Each assignment took me the time allotted. Simply put, I started on the research as soon as I received the topic. and sometimes, it seemed as if the three weeks was not enough.

Travelling and Communication

How did travelling impact your ability to study?

I did not have to travel a lot so it did not impact me.

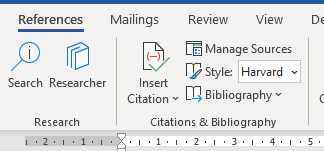

How were you able to interact with peers and/or professors given the time differences?

It was difficult. In my situation, there were two classes where I met two other ladies that lived not very far from my house, so it was easy to have study sessions. In dealing with professors, I usually emailed with questions and always got a prompt response back. Studying online is always a challenge as the face to face is never there.

A typical day as a master’s student

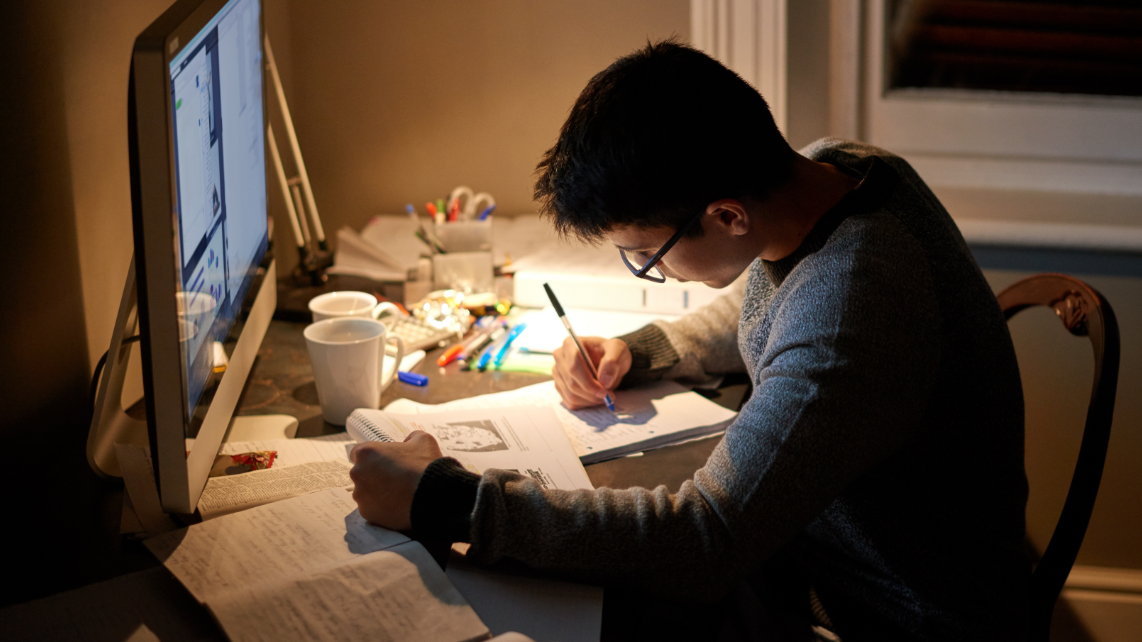

What does a typical day as an Online Masters’ student look like for you?

In the morning it starts with work and maybe during the day, if not busy at work, will work on research for my paper and then in the evenings, will spend a couple of hours with my reading and then on weekends will work on my paper.

Any advice you have for students to better plan their studies

Start from day one. Don’t procrastinate as 3 weeks goes by very fast. The material is a lot of go over and then you have the work to do. Keep in touch with your professor and ask any questions you have for clarifications as you work on your assignments. Reach out to peers, as they can be helpful as well. Usually peers will create a WhatsApp group, be a part of it..it makes it seem as if you are in a classroom…as it can be very noisy. A great program. Goodluck and I wish you well.

If you are considering getting your master’s degree, now would be an excellent time to take the plunge. Look at our programme list and see if we have anything that could help.

I hope this blog has answered some of your questions, and please watch this place for more similar blogs. You can also chat LIVE on WhatsApp with one of our Education Advisors for more information on all the programmes we offer, the application process, and the discounts we might offer.