An on-campus education offers a number of traditional benefits – from access to the infrastructure of the university, face-to-face interaction with the faculty, and better networking opportunities with your peers, to on-campus placements and career opportunities.

However, with the access given us by technology these “traditional benefits” are no longer unique to an on-campus education.

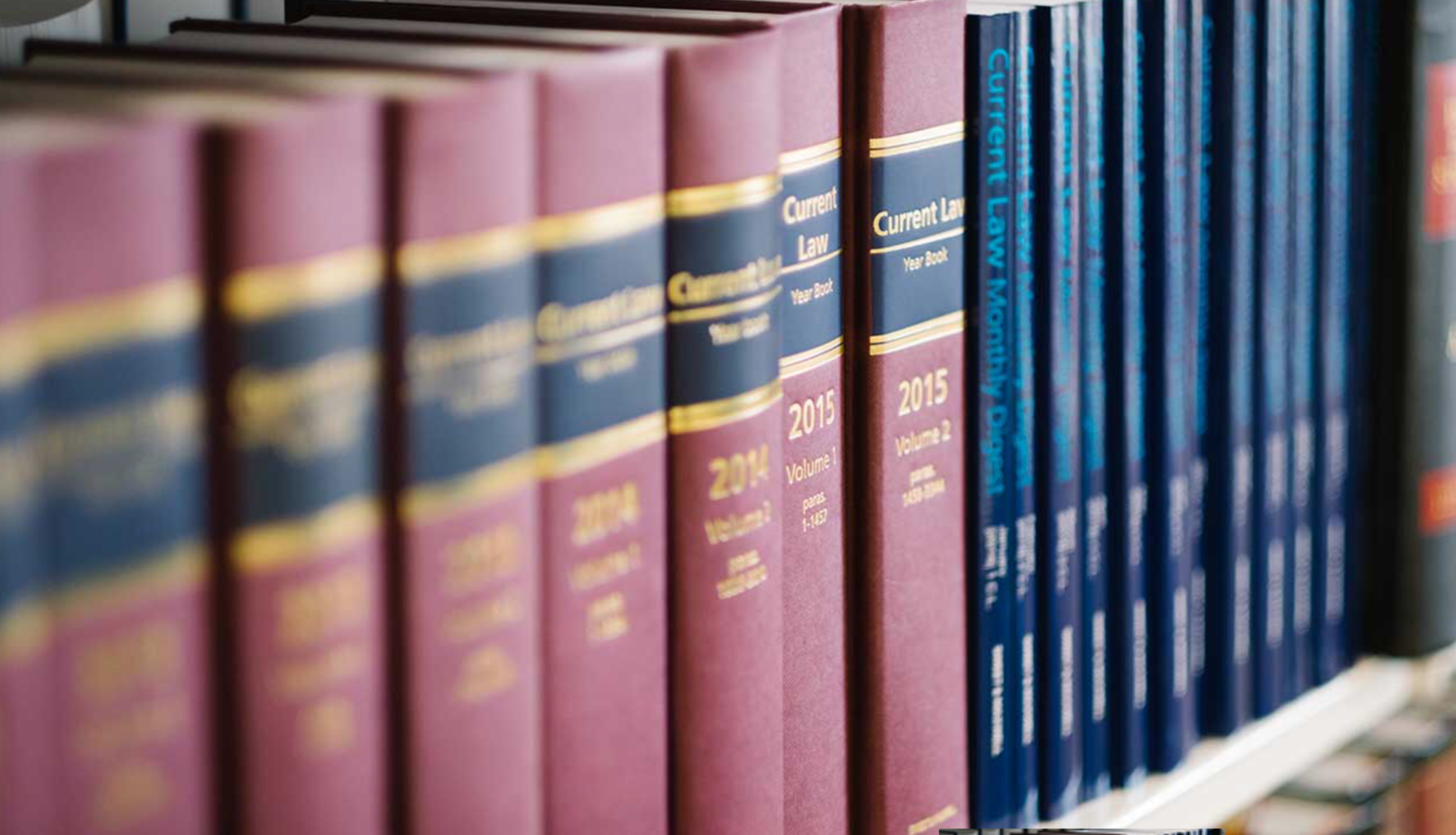

Most universities that offer an online programme usually give their students access to their online libraries. These online libraries usually come better stocked with a wide range of reference papers and ebooks as there is no physical space required for the library and these online libraries can be accessed by students at any time and from anywhere in the world.

Most universities that offer an online programme usually give their students access to their online libraries. These online libraries usually come better stocked with a wide range of reference papers and ebooks as there is no physical space required for the library and these online libraries can be accessed by students at any time and from anywhere in the world.

A number of online education institutions have also adapted video communication tools like Skype, Facetime, etc., to give a virtual classroom experience to their students. Through these virtual classrooms students can interact live with the faculty and fellow students, discussing subjects, answering questions and experiencing a classroom environment from the comforts of their homes.

Through social media, students and institutions have created a more extensive and robust network than anytime before in history, creating platforms for not only the sharing of ideas and discovering partnerships but also creating and broadcasting job opportunities that might have otherwise have gone unnoticed.

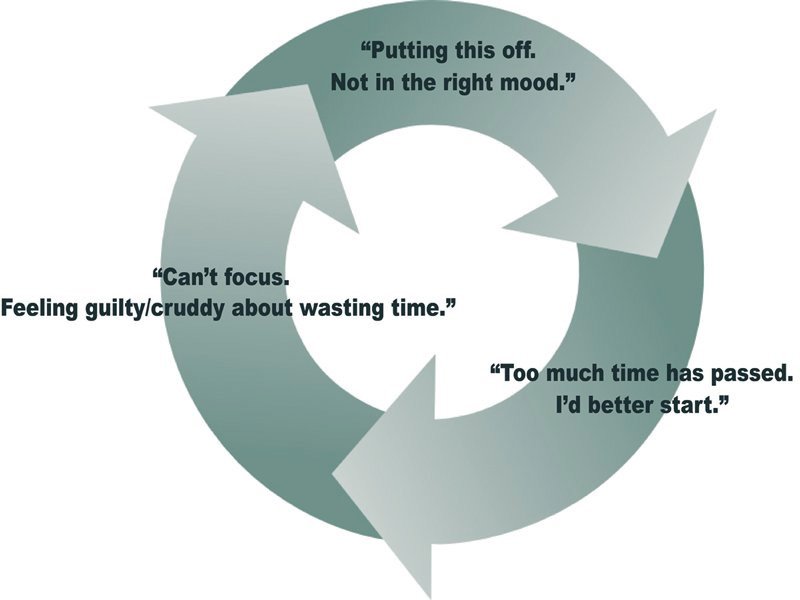

Another advantage of an online education is that most of the students who enrol in a programme also have a full-time career and are pursuing their education parallel to career and life commitments in order to enhance their career prospects. Having to effectively manage work, life and education has the added benefit of making a student learn to manage time better and become more self-disciplined.

In today’s global village, organisations are truly multinational and technology plays a vital part in the decision-making and communication process of an organisation. Having completed an online programme, students are prepared for this modern business environment, with familiarity in online communication and information platforms and learnt skills in online research, data mining and appropriate writing etiquette.

Robert Kennedy College with almost 14,000 students from almost every county in the world offers one of the most diverse online master’s degree programmes in both Law and Business through exclusive partnerships with British universities. For more information download programme catalogue.

Collaboration – A

Collaboration – A